See This Report on Real Estate Reno Nv

The Buzz on Real Estate Reno Nv

Table of Contents8 Easy Facts About Real Estate Reno Nv ShownNot known Incorrect Statements About Real Estate Reno Nv Not known Incorrect Statements About Real Estate Reno Nv The Single Strategy To Use For Real Estate Reno NvThe Ultimate Guide To Real Estate Reno NvLittle Known Questions About Real Estate Reno Nv.

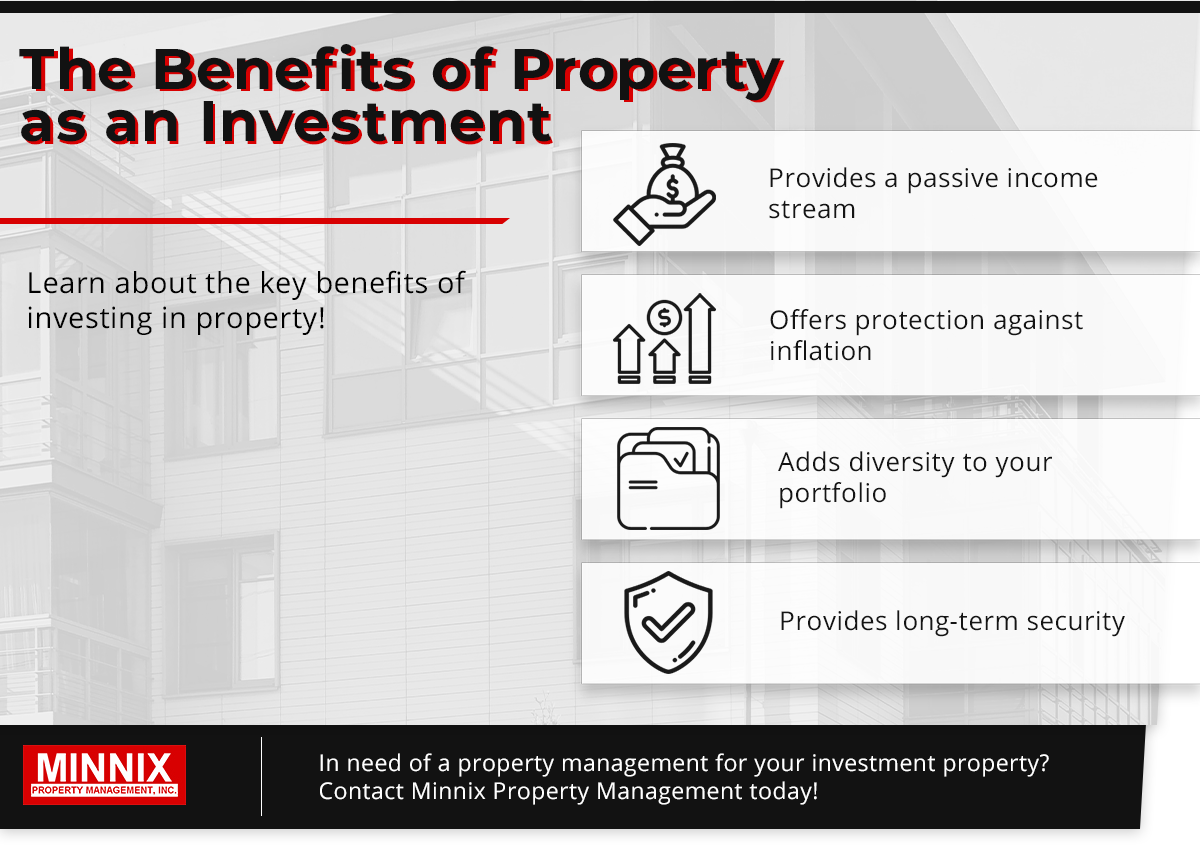

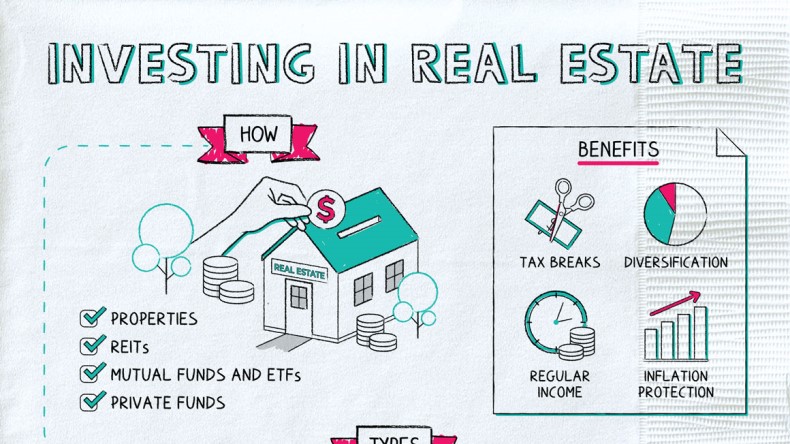

The advantages of buying realty are numerous (Real Estate Reno NV). With well-chosen possessions, financiers can delight in predictable cash money circulation, exceptional returns, tax advantages, and diversificationand it's feasible to utilize real estate to build riches. Thinking concerning purchasing actual estate? Here's what you need to understand regarding property advantages and why realty is considered an excellent investment.

The benefits of buying genuine estate consist of easy revenue, steady capital, tax benefits, diversification, and leverage. Realty investment trusts (REITs) offer a means to purchase realty without having to have, run, or money residential properties. Capital is the earnings from a property financial investment after home mortgage settlements and operating costs have been made.

Real estate values tend to raise over time, and with an excellent financial investment, you can turn a profit when it's time to offer. As you pay down a home home mortgage, you build equityan property that's component of your internet well worth. And as you construct equity, you have the take advantage of to buy more residential properties and boost cash circulation and riches also extra.

Real estate has a lowand in many cases negativecorrelation with other significant property courses. This implies the addition of property to a portfolio of diversified possessions can lower portfolio volatility and give a higher return per system of threat. Utilize is using numerous financial instruments or obtained resources (e.

The Real Estate Reno Nv Ideas

As economic climates broaden, the need genuine estate drives rents greater. This, in turn, converts right into higher capital values. Actual estate tends to keep the buying power of funding by passing some of the inflationary pressure on to occupants and by integrating some of the inflationary stress in the kind of resources gratitude.

There are a number of methods that possessing property can safeguard against inflation. Initially, residential property worths might climb more than the price of inflation, causing funding gains. Second, rental fees on investment buildings can increase to stay up to date with inflation. Residential properties funded with a fixed-rate financing will certainly see the relative amount of the monthly home mortgage payments drop over time-- for circumstances $1,000 a month as a set payment will certainly end up being much less burdensome as inflation wears down the buying power of that $1,000.

One can make money from offering their home at a rate better than they paid for it. And, if this does happen, you might be accountable to pay tax obligations on those gains. Despite all the benefits of spending in genuine estate, there are downsides. Among the main ones is the lack of liquidity (or the loved one problem in converting a possession into cash money and money right into an asset).

The 9-Minute Rule for Real Estate Reno Nv

Yet among the easiest and most common techniques is just getting a home to lease out to others. Why spend in genuine estate? After all, it calls for a lot more job than simply clicking a my sources few switches to purchase a shared fund or supply. The reality is, there are many realty advantages that make it such a prominent selection for knowledgeable investors.

The rest goes to paying down the car loan and building equity. Equity is the value you have in a home. It's the distinction between what you owe and what the residence or land deserves. Gradually, routine repayments will eventually leave you owning a property complimentary and clear.

Real Estate Reno Nv - The Facts

Any person who's shopped or filled their container recently understands just how inflation can destroy the power of hard-earned money. Among the most underrated actual estate advantages is that, unlike many typical financial investments, property value has a tendency to rise, also during Learn More Here times of remarkable inflation. Like various other vital assets, realty often retains worth and can for that reason work as an excellent location to invest while higher costs gnaw the gains of different other investments you might have.

Recognition describes money made when the total worth of a property climbs between the moment you purchase it and the moment you offer it. For genuine estate, this can mean considerable gains because of the normally high costs of the possessions. Nonetheless, it's essential to bear in mind gratitude is a single thing and only gives cash when you offer, not along the road.

As discussed earlier, capital is the money that comes on a month-to-month or annual basis as a result of owning the building. Generally, this is what's left over after paying all the needed expenses like home mortgage repayments, repair services, tax obligations, and insurance policy. Some homes may have a considerable capital, while others may have little or none.

Fascination About Real Estate Reno Nv

Brand-new financiers may not absolutely comprehend the power of take advantage of, but those who do unlock the potential for big gains on their investments. Generally talking, take advantage of in investing comes when you can find out more you can own or control a larger quantity of assets than you can or else spend for, with using credit history.